Aml Risk Meaning

The concept of cash laundering is very important to be understood for these working in the monetary sector. It is a course of by which dirty cash is converted into clear money. The sources of the cash in precise are prison and the cash is invested in a method that makes it look like clear cash and conceal the identity of the legal part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or maintaining current customers the responsibility of adopting enough measures lie on each one who is part of the organization. The identification of such ingredient at first is straightforward to deal with instead realizing and encountering such situations in a while within the transaction stage. The central financial institution in any nation gives complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such situations.

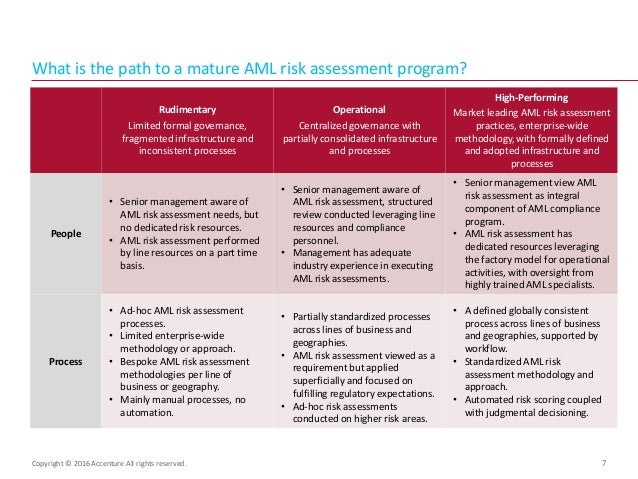

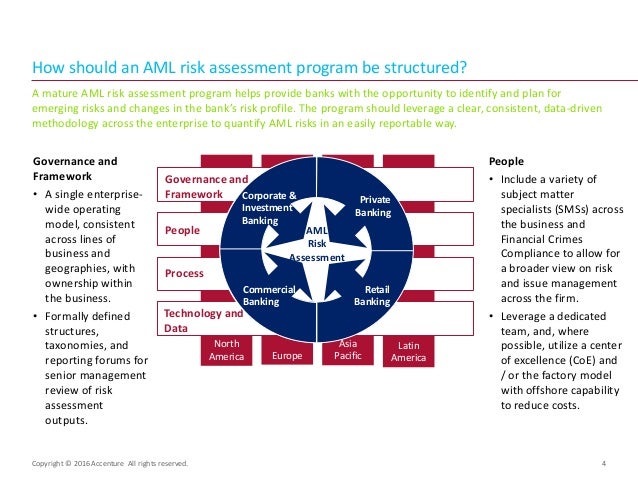

T he risk-based anti-money laundering AML principle was first promoted by British regulatory authorities. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Difference Between Kyc And Aml Tookitaki Tookitaki

255 rows The theory supporting risk assessment tools and templates is based on the concept that a.

Aml risk meaning. With that in mind the key AML lending risks include. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Regulators agree specific areas within a business either increase or decrease the risk.

According to the UNDOC the amount of money being laundered across the globe every year is equivalent to 2. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Translocation between chromosome 9 and 22.

In risk management terminology these are known as Key Risk Indicators KRIs. AML Risks in Foreign Exchange. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of.

Fraud is on the rise Fraud is increasing day by day. Translocation between chromosome 6 and 9. AML Risk in Real Estate Sector.

Conventional AML measures in banks and other brick-and-mortar lending businesses allow for the verification of customer identities in person via customer due diligence CDD checks. Translocation or inversion of chromosome 3. Poor or less-favourable risk means that the person with AML has the following chromosome changes.

The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. Translocation between chromosomes 9 and 11.

How to Comply Foreign currency exchange FX is a popular methodology for money launderers who seek to exploit a range of. As previously mentioned a risk-based approach to AML is one that involves identifying suspicious activity and the risk involved in working with certain kinds of clients so as to prevent money laundering before it occurs. The AML risk assessment has the purpose of measuring the likelihood that a business will be used to unwittingly facilitate money laundering or financing of terrorism.

In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Significant profit potential for the bank. AML compliance in banks and businesses is a primary source of risk prevention.

Effective policies procedures and processes can help protect banks from becoming conduits for or victims of money laundering terrorist financing and other financial crimes that are perpetrated through private banking relationships. The technological shift in financial infrastructure and the rise of online payments has increased the risk of multiple folds. What is a risk-based approach to AML.

Deletion of part of chromosome 5 or 7. The anti-money laundering function that constantly monitors by means of indicators of anomaly which business activities considered fragile for possible criminal infiltration can be subjected to a risk of instrumental use of cash and money to carry out conducts of abnormal transfer or placement in the internal. What is AML Anti-Money Laundering.

In a digital lending context however criminals are better able to conceal their identities when using online services or use proxies to apply for loans on. Money laundering the act of concealing the illegal nature of ill-gotten money is an international problem. Abnormalities of chromosome 11.

What is correspondent banking AML risk.

Anti Money Laundering Aml Risk Assessment Process

Financial Crime Risk Assessment Acams Today

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Money Laundering Risk Definition Money Laundering Is The Illegal Process Of Making Large Amounts Of Money Generated By A Criminal Activity Such As Drug Trafficking Or Terrorist Funding Appear To Have

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering Overview Process And History

An Introduction To The 360 Degree Aml Investigation Model Acams Today

Money Laundering Risk Definition Money Laundering Is The Illegal Process Of Making Large Amounts Of Money Generated By A Criminal Activity Such As Drug Trafficking Or Terrorist Funding Appear To Have

Aml Ewra How To Conduct Anti Money Laundering Overall Risk Assessment

Money Laundering Risk Definition Money Laundering Is The Illegal Process Of Making Large Amounts Of Money Generated By A Criminal Activity Such As Drug Trafficking Or Terrorist Funding Appear To Have

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf

Anti Money Laundering And Counter Terrorism Financing

The world of rules can appear to be a bowl of alphabet soup at instances. US money laundering laws are no exception. We have now compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting financial services by reducing threat, fraud and losses. We have massive financial institution experience in operational and regulatory risk. We have a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic penalties to the organization due to the dangers it presents. It increases the likelihood of major dangers and the opportunity price of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment